OE has raised its 2024 GDP forecast with growth of 0.9% now predicted for the year, up from 0.6% last month. Consumers are expected to lead the recovery in the next two years, buoyed by improving real household incomes as the rate of inflation falls. The gradual easing of monetary policy will also contribute to growth, though the lagged impact of previous interest rate rises will still weigh on households this year. OE also notes that tightening fiscal policy – which is likely to persist after the next election – will also act as a brake on growth.

Economic Growth

The UK exited recession in Q1 2024, with estimated quarterly growth of 0.6%. This stronger-than-anticipated start to the year was driven by growth in the services and production sectors and strong household spending, likely related to this year’s earlier Easter. Indicators point to momentum continuing into Q2. While businesses are grappling with challenges and increased costs – including the rise in Living Wage – business surveys point to continued pickup in investment and sentiment.

Inflation

According to the ONS, the easing of the inflation rate reflects price falls for energy, food and non-alcoholic beverages, recreation/culture and communication. The largest upward contributions came from motor fuels. The pace of annual food price hikes has been easing in recent months, dropping from a peak of 19.2% in March 2023 (the highest in over 45 years) to 4% in March.

Unemployment

According to the ONS’s Labour Force Survey, employment growth has slowed over the last 12 months, while the proportion of people economically inactive has increased. Of particular note, historically high numbers of people across all age groups are reporting that they are long-term sick.

Earnings

From January to March, average total earnings grew by 5.7% and regular earnings (excluding bonuses) by 6%. After inflation, total earnings rose by 1.7% in the three months to March.

Key Drivers of the Short-term Outlook

- Inflation will fall below 2% for much of H2 2024.

- The Bank Rate will end the year at 4.5%.

- The impact of tighter monetary policy will continue to emerge.

- Fiscal policy will tighten.

- House prices will fall only slightly, despite being significantly overvalued.

What to Watch Out For

- The impact of the Israel-Hamas war

- Changes to fiscal approach

- Rising corporate insolvencies

- Consumers spending their pandemic savings

UK Election Focus - snap election highlights global challenges

2024 is a big year for elections worldwide with voters in 8 of the 10 most populous nations exercising their rights. One unknown factor had been when the UK would go to the polls, but prime minister Rishi Sunak put an end to uncertainty by announcing a general election on July 4th. His Conservative party has been trailing the opposition Labour party, led by Keir Starmer, in the polls for many months, meaning a change of government is the most likely outcome. The month of June is due to be filled with campaigning.

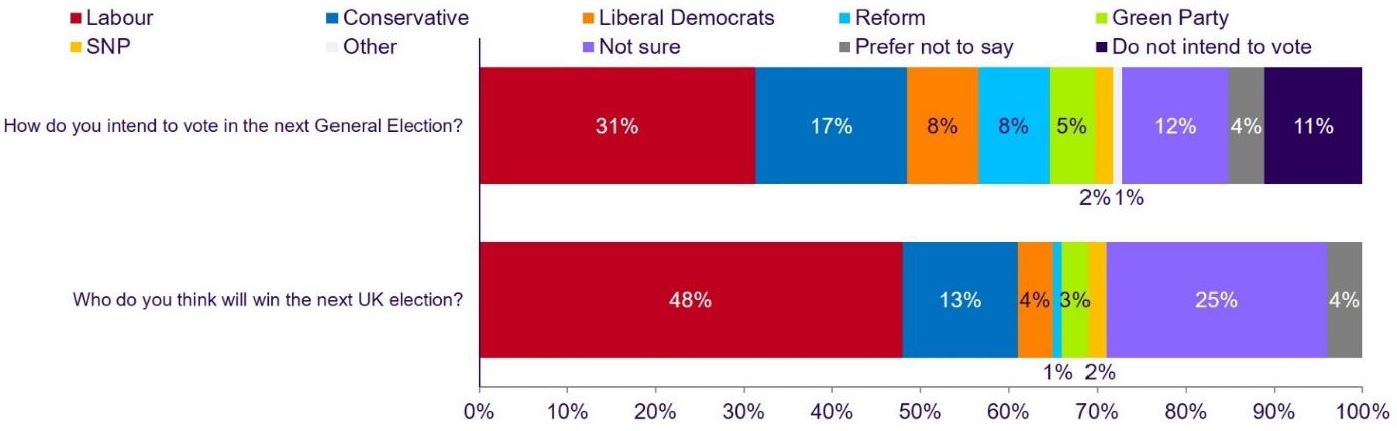

Views on the next UK General Election

Data from our most recent GB research, which took place in April and early May, confirms that when asked how they intend to vote in the next election (which had not been announced at that stage), Brits were most likely to say Labour, on 31%, ahead of the Conservatives on 17%. Notably, almost 3 in 10 were either undecided, preferred not to say or intended not to vote. When asked who they thought would win, almost 1 in 2 said Labour, but 1 in 4 were not sure (source: Foresight Factory, 2024). This shows that even some supporters of other parties acknowledge that Labour’s significant and longstanding lead in the polls means they are most likely to form the next government.

Election Macro Drivers

The macroeconomic picture is among the foremost issues under debate in the run-up to the election. Just days before the election was announced, the International Monetary Fund warned that Britain needed to find £30 billion ($38.2 billion) extra in order to stabilize debt, meaning that whoever wins the election will have less room for maneuver when it comes to spending pledges or tax rises.

What’s more, the UK’s demographic outlook is characterized by an aging population, placing further pressure on national finances. One topic that’s often seen to be uppermost in the minds of British voters is the future of the country’s National Health Service. As we explore in our Health Horizons macro driver, the rising cost of healthcare is a topic that governments around the world will have to increasingly grapple with in years to come.

As with other elections taking place this year, artificial intelligence is one form of technological progress that could have a negative effect on voter trust. We reported last month how deepfakes were already being used in India’s general election, with examples of long-deceased figures being resurrected digitally in order to campaign. There have been warnings that similar tactics could be deployed in the UK election, potentially by outside actors such as Russia, China and North Korea.

Indeed, geopolitical forces are likely to play a part in the election, which takes place against a backdrop of significant global tensions and conflict. In particular, it has already been suggested that the conflict in Gaza had an impact on voting patterns in local elections in the UK, with some Muslim voters reportedly turning away from the Labour party due to the party’s stance on the issue. Not long before announcing the election, Rishi Sunak warned in a speech that factors such as geopolitics and AI meant that the UK faces dangerous years ahead, and future spending on defence is likely to be an electoral battleground. Immigration is another topic that is likely to receive attention here, with the government’s efforts to stem illegal migration from continental Europe generating much debate in recent months and years.

Environmental challenges are also likely to feature in debates. One of Labour’s “first steps for change” is to set up a publicly owned clean power company called Great British Energy. The party had previously pledged to spend £28 billion (c. $35 billion) on green industries, but this policy was scaled back earlier in 2024 due to a more challenging economic outlook.

See previous UK Economic Snapshots

Produced by the Foresight Factory for the IPA Commercial Group