To move forward in the next frontier of marketing effectiveness measurement, we must incorporate Owned experiences. Having new tools to measure the whole brand and customer experience should help.

This year at the IPA EffWorks Global 2023 conference, we presented the results of our work with industry leaders on progress in Owned Channel measurement and future challenges.

This built on last year’s report for IPA EffWorks which argued that Owned Channels are the next frontier for marketing effectiveness measurement.

One of the issues that emerged from speaking with clients, agencies and measurement experts in 2023, was the danger of continuing not integrating Owned Channels in marketing plans.

As most evaluation focuses on paid media optimisation, Owned Channels are often missed entirely, or lost in data noise or limitations of many marketing evaluation techniques. The result is misattribution and severely misguided investment decisions.

David Beaton, one of my co-founders at the marketing collective Crater Lake & Co, argued that to avoid making such investment mistakes, we need to start from an integrated perspective across Paid, Earned and Owned media. If we do not, we run the risk of leaving more unexplained in the baseline of our modelling, attributing impact to Paid Channels that should have been attributed to Owned and Earned, and mis-investing accordingly.

To help marketers overcome this danger, we are making some new resources available, including a new dashboard to enable agencies and clients to see how different combinations of channels impact experiences in several categories.

1. Owned Channels Definition

Defining Owned Channels is nuanced and constantly evolving. One important insight we came to understand through this research is that Owned can’t be defined by Channel, it is the experience that someone has that defines whether they believe it to be Owned. Reflecting this, we have adopted this simple definition:

“Owned Channels are those created by the brand or company and those which people perceive the brand to have some control over as they interact with them.”

2. A new approach to integrating metrics

My colleague, David Beaton, offered a Hub and Spoke solution for integrating the different metrics used across Owned, Paid and Earned channels.

According to this approach, it is important to have a language which is common to all channels for the model used in the hub. For instance, geography could be this common language.

The individual measures used for different channels appear in the spokes. Each spoke would be fully evaluated to understand its contribution to the hub.

3. A new score for how people experience brands across channels

MESH Experience has developed an Experience Impact Score and showed this for the first time at EffWorks Global 2023.

The Experience Impact Score (out of 100) comprises the quantity and quality of experiences that people are having with a brand across all its points of contact. The score has been validated against a basket of brand equity metrics including brand consideration, trust and Net Promoter Score (NPS). The higher the score the bigger impact on brand equity.

From the chart, we see that Barclays has a score of 72. Half of the impact of this score, 36, is coming from Owned experiences.

Experience Impact Score

When we decompose this further, we can see that it is the app and online banking that are making the biggest contribution to Barclays Experience Impact Score, followed by TV advertising. See the EffWorks 2023 presentation slides for more detail.

4. A new dashboard for marketers

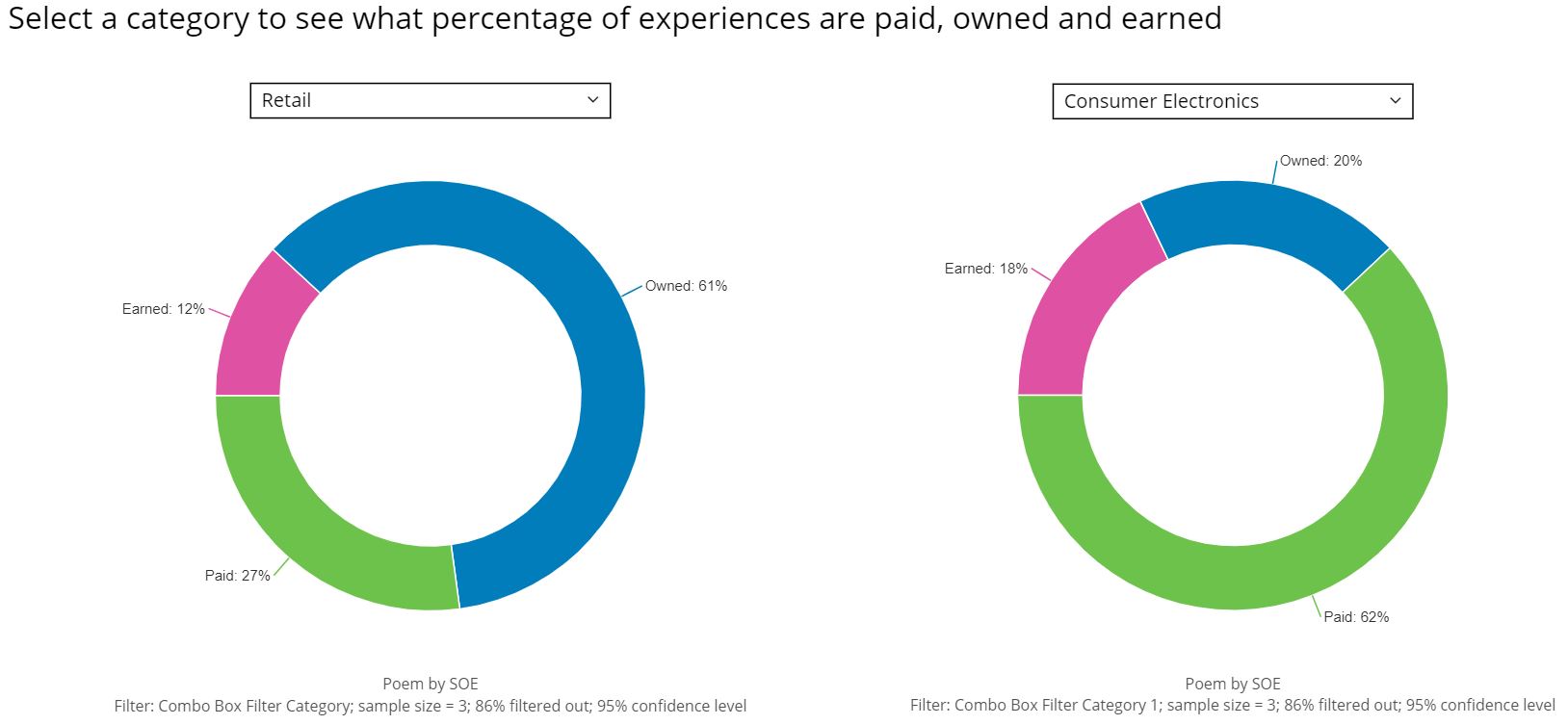

MESH Experience has launched a dashboard to help agencies and clients understand the proportion of Owned experiences in relation to Paid and Earned in different categories.

Category Share of Experience

For instance, in retail, Owned is dominant (with stores, apps, online websites and CRM), whereas Paid is dominant for comparison websites and Earned becomes more important for packaged goods and electronics (where people are seeing others use or consume brands).

There are also some lists of Paid, Owned and Earned experiences which are illustrative of the types of experiences to be mindful of when creating and measuring activity.

Why not hop onto the dashboard for a quick look?

5. Owned Channels and IPA TouchPoints

Daniel Flynn, Deputy Research Director, IPA, is working with agencies on increasing the amount of Owned data featuring in the IPA TouchPoints Channel Planner.

The TouchPoints Channel planner takes data from all the advertising measurement currencies, known as ‘the JICs’, such as BARB for TV, RAJAR for radio, UKOM for digital display and social etc.

For the purpose of our joint EffWorks 2023 presentation with Dan, we used MESH Experience data for the percentage of people who have reported within MESH research the experience of noticing, for example, an App from their bank or their bank’s TV ad.

In the slide below, ‘app from bank’ refers to the Lloyds app which is captured in the UKOM data and feeds into the TouchPoints Channel Planner. Using the planner, Dan then put in the number of impressions required to achieve noticeability of 2.9%. The potential for more integration of Owned into tools like the Planner is very exciting.

Mesh Experience; Noticeability by brand (Lloyds)

Challenges ahead

Our industry leaders identified cultural and structural hurdles we need to overcome in the Owned Channels field. As one client expressed: “The biggest hurdle is the way companies operate. There are so many matrix organisations. Lots of people contribute to one Owned Channel. No single person has overall control of it.”

This can lead to “orphaned measurement”.

Silos with customer experience teams having different models to marketing teams can lead to conflict and confusion. Yet it is clear that to move forward in the next frontier of marketing effectiveness measurement, we must incorporate Owned experiences. Having new tools to measure the whole brand and customer experience should help.

Please join us by getting in touch with Fiona Blades or Daniel Flynn.

Access the Share of Experience Dashboard

The opinions expressed here are those of the authors and were submitted in accordance with the IPA terms and conditions regarding the uploading and contribution of content to the IPA newsletters, IPA website, or other IPA media, and should not be interpreted as representing the opinion of the IPA.