Dominic Charles, Managing Director, Audience Intelligence & Marketing Science, Wavemaker UK & Jane Christian, Managing Director, Analytics & Insight, EssenceMediacom, look at how effective media investment planning is about balance – what’s the right combination of channels that give me the sales effect I need, for the spend I have, in the time I need?

It’s been over a decade since Binet & Field published the seminal piece of work The Long and the Short of It which provoked the industry to address the imbalance between short-term sales activation-focused ‘performance’ campaigns and investment in long-term brand building. Whilst that piece of work has rightly served as a rallying cry to drive greater investment into brand building resulting in more effective growth for brands, a curious side effect of this analysis has been to create an arbitrary framing when it comes to media channels between ‘brand’ and ‘performance’.

This arbitrary division of media channels is at best unhelpful, creating a silo in media plans where one doesn’t need to exist, and at worst leads to brands harming their short- and long-term growth by restricting their options in both directions. The Brand versus Performance framework is ultimately not helpful as it doesn’t reflect how different media channels pay back – all channels can generate short-term sales payback and they all generate payback through long-term sustained base growth.

As part of the recent Profit Ability research, commissioned by Thinkbox and utilising econometric benchmarks from Ebiquity, EssenceMediacom, Gain Theory, Mindshare & Wavemaker UK, presented at a Thinkbox event, we looked into how advertising actually impacts the bottom line of businesses.

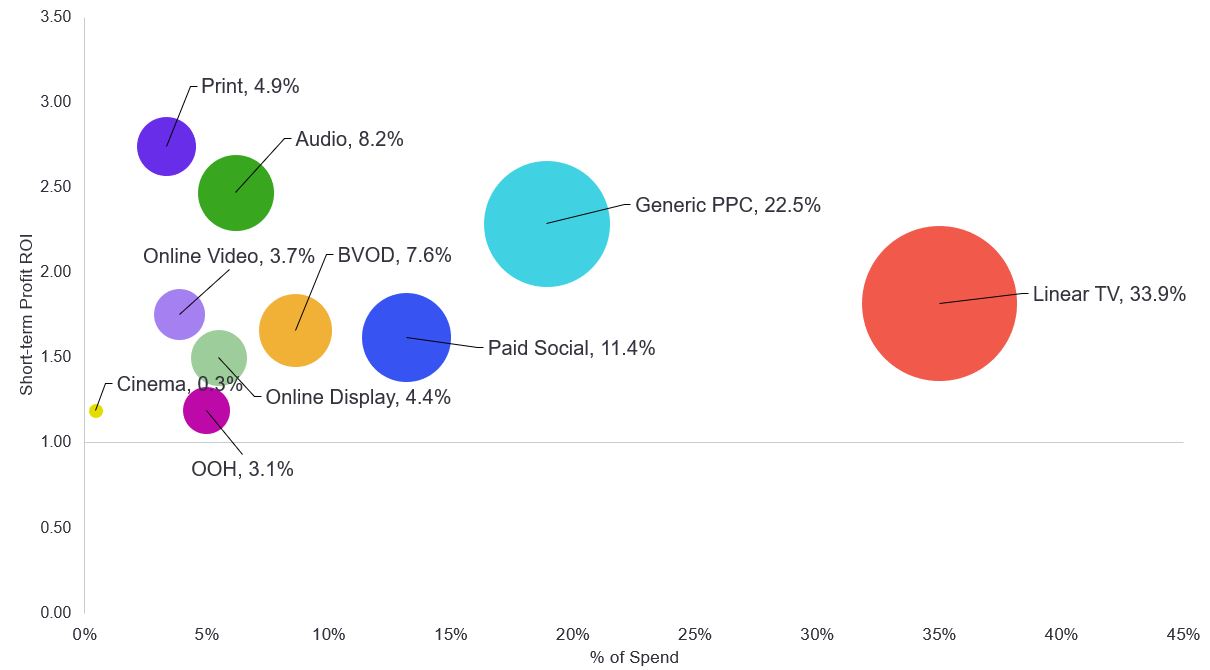

Looking at the data, we can see that all media channels benchmarked in the study on average generate a profitable return in the short-term (within three months of advertising) with channels like Linear TV generating the largest overall short-term payback to a business. In the chart below, the size of the bubble reflects the percentage of profit volume attributed to individual media channels.

Short-term profit volume & profit ROI, bubble size represents % of short-term profit volume, overall short-term profit ROI: £1.87

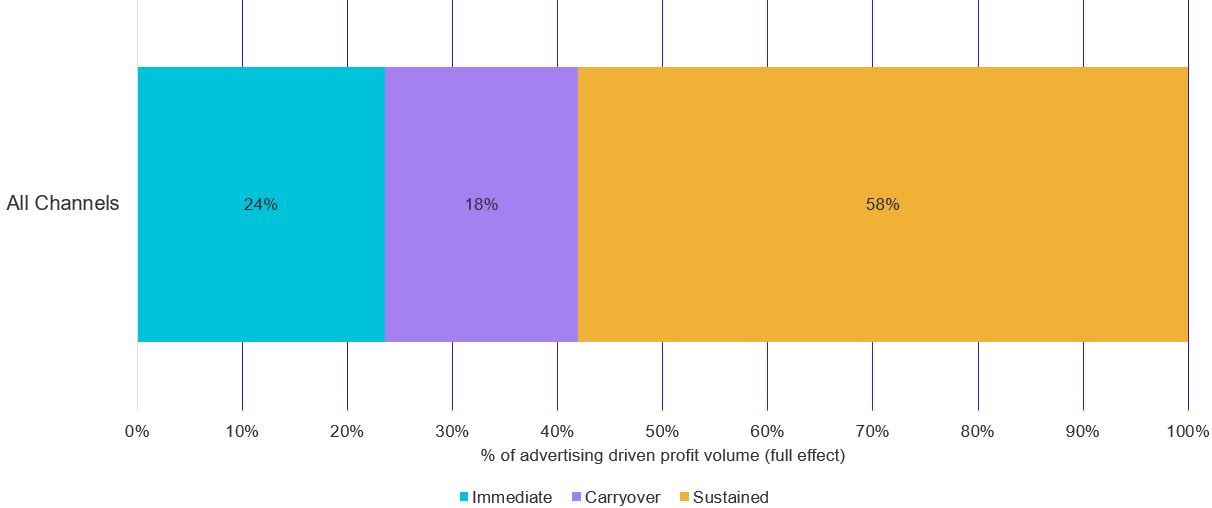

But equally all channels create sustained effects that pay back to a business over the longer term (between four months and two years from the advertising spend) and these effects are often substantial, on average over double the short-term effect of the channel.

So quite quickly it becomes apparent that ‘brand’ and ‘performance’ does not represent the real-world payback of advertising. Therefore, when determining the right channel investment, a more helpful framing is to think of things through the lens of three dimensions of effectiveness:

- Scale – the size of advertising’s effect on the business

- Efficiency – the ratio between cost and the effect on the business

- Time – the period over which advertising pays back

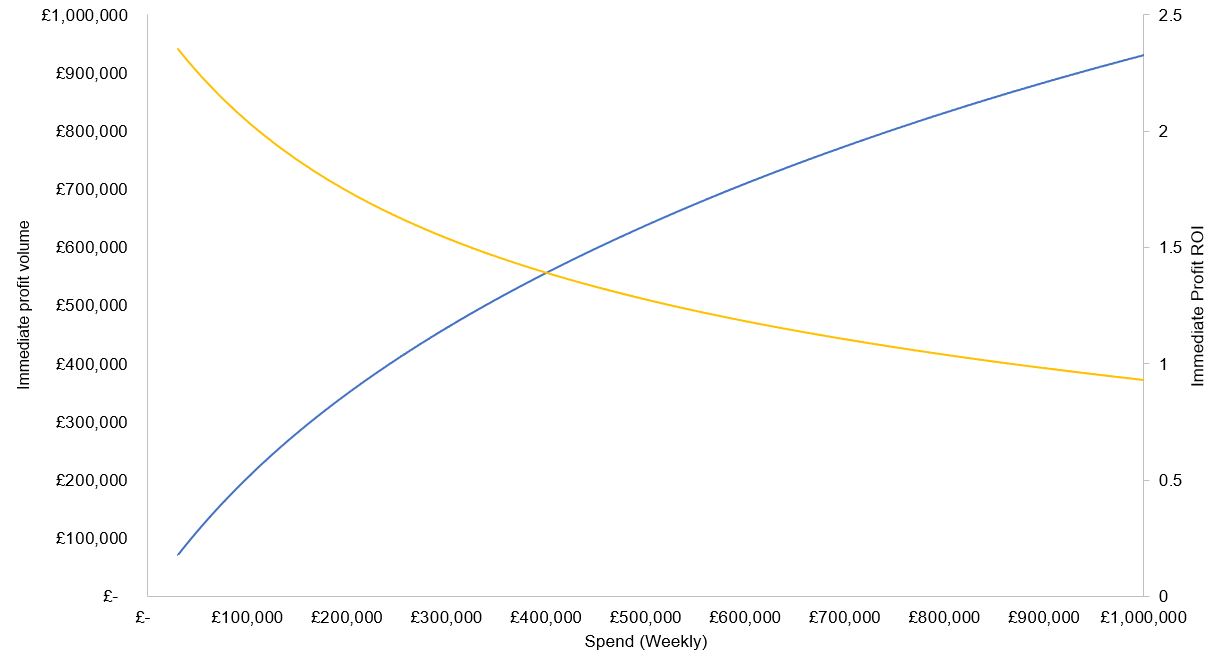

In principle, Scale is fairly simple to understand – the more I spend, the more I get back. However, this relationship is not linear. As spend increases, it gets harder and harder to drive incremental sales because of diminishing returns, either because I’m running out of new people to talk to (driving excessive frequency) or I’m having to broaden my audience targeting to increase spend and therefore I am talking to people who are less likely to purchase and/or are less warm to my brand.

Scale and efficiency are ultimately linked. As my spend increases, so does my scale but my efficiency decreases as diminishing returns start to kick in. The reverse is true, reducing spend and reducing the size of the effect on the business will improve efficiency, as measured by immediate profit ROI.

Weekly profit volume & Profit ROI - Linear TV

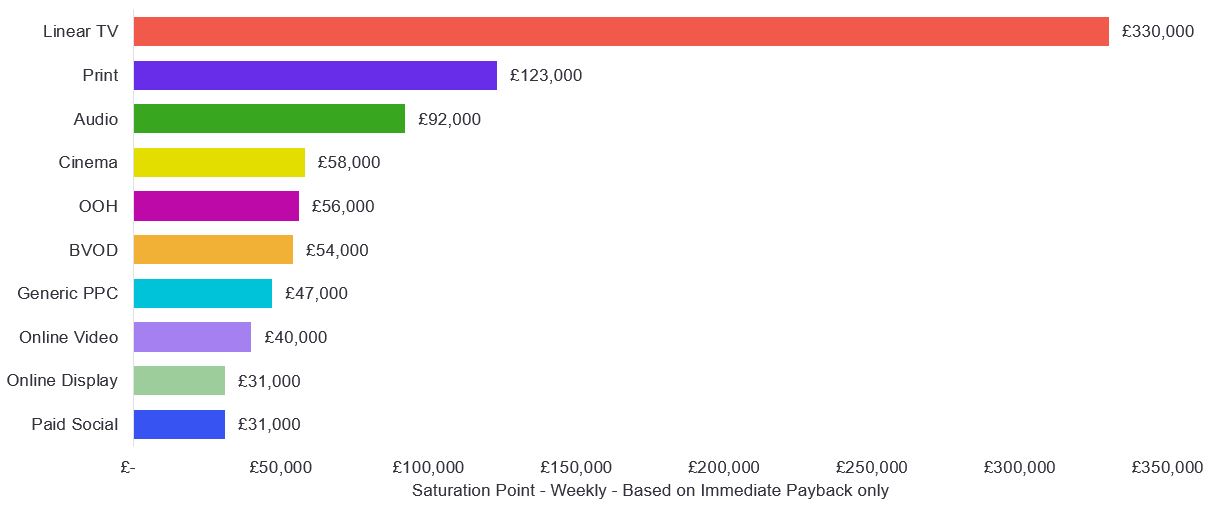

This is why ROI alone is not a useful metric. I can improve ROI easily, I’ll just spend less but as a consequence drive fewer sales. Finding the most efficient way to drive the required scale is ultimately the balance we need to strike. Within the research, we wanted to get a better understanding of the balance between scale and efficiency. To do this, we looked at the saturation point for each channel. This is the point where the next £1 of incremental spend in a channel doesn’t give us £1 back. Channels with high saturation points can accommodate high spends more profitably than those with lower saturation points.

Saturation based on immediate payback - all category average

The results show that broad channels like Linear TV are able to scale more profitably than more precision targeted digital channels. It’s worth noting that this doesn’t mean overall ROI is higher in the channels that have higher saturation points, rather that they can handle higher spends better.

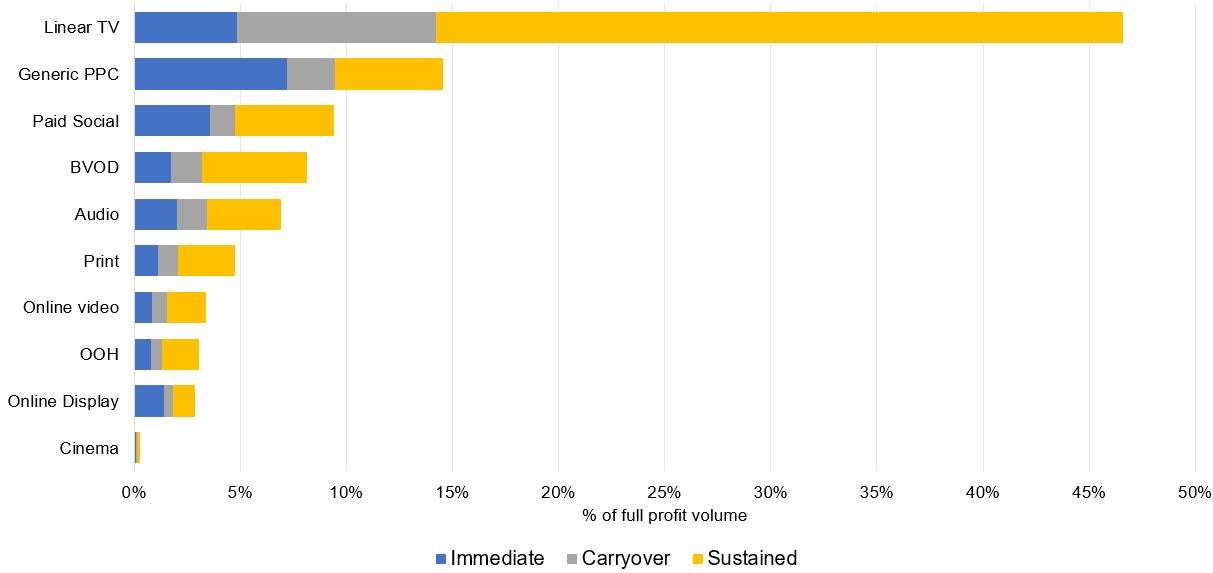

The third dimension is time: when does the payback need to hit the bottom line? In analysing the data, we looked at three broad periods of payback:

- Immediate – the payback the same week of advertising

- Carryover – the remaining short-term payback (generally two to 13 weeks after advertising)

- Sustained – the contribution of advertising to base sales over the medium to long term (up to two years)

Depending on the timeframe we’re looking at, different channels have natural strengths. Generic PPC, for example, generates the largest immediate sales effects. That said, what becomes quickly apparent is that ‘brand’ channels such as Linear TV, audio & BVOD are just as strong at driving short-term sales effects as the ‘performance’ channels (Generic PPC, Paid Social & Online Display), but equally over the longer term ‘performance’ channels can generate decent sustained effects.

Ultimately, effective media investment planning is about balance – what’s the right combination of channels that give me the sales effect I need, for the spend I have, in the time I need? Thinking about the three dimensions of effectiveness and about how media channels each have their own strengths and weaknesses, coupled with investing in measurement such as marketing mix modelling to understand these dynamics for your individual business, will lead to more effective plans that drive more growth than focusing on an arbitrary split of media channels which is not rooted in how advertising actually pays back.

Watch all the sessions from the Thinkbox event on ‘The new business case for advertising’

The opinions expressed here are those of the authors and were submitted in accordance with the IPA terms and conditions regarding the uploading and contribution of content to the IPA newsletters, IPA website, or other IPA media, and should not be interpreted as representing the opinion of the IPA.