For a market worth over £6 billion in the UK, it’s time the industry fast tracked our understanding and clarity in programmatic advertising. Here the IPA’s Director of Media Affairs Nigel Gwilliam sets out the current state of play and next steps off the back of the ISBA PwC Programmatic Supply Chain Study.

In a recent podcast interview unpacking the ISBA PwC study, one of the report co-authors Sam Tomlinson of PwC, had some sage advice for advertisers:

If I was a brand, for something this complicated, I would want the very best team working on my account and I would be prepared to pay accordingly.

Many agencies would rightly argue that is true of all advertising but let’s focus on the subject at hand, programmatic advertising.

What is it?

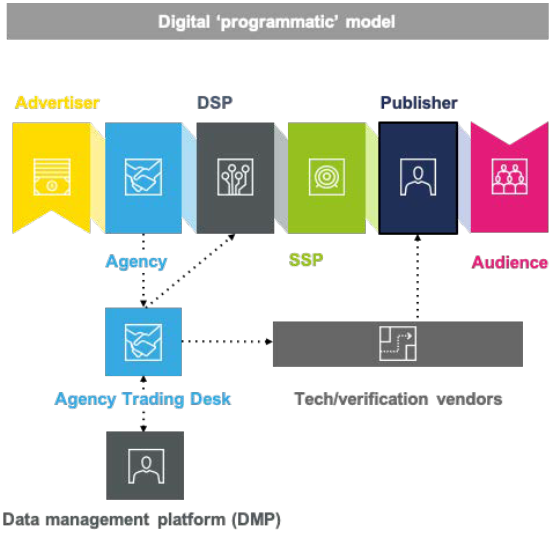

Put simply programmatic advertising is the automated buying and selling of advertising inventory. Primarily internet-based media inventory – on websites and mobile apps, but increasingly TV and even Out of Home.

Why all the fuss about Programmatic?

When done well, for example using lots of data to help deliver against key insights, it can be incredibly effective. This is well demonstrated by UM in the IPA Effectiveness Award Winning Campaign for The Economist and Mediacom’s Campaign Tech Award winning campaign “Winter is Coming” for British Gas.

With ever more powerful ad tech having access to ever larger plumes of data, the opportunity is growing. Hence UK programmatic digital display spend will grow from around £6 billion in 2019 to around £8 billion in 2021. And the figures for the US are nearly tenfold (source: eMarketer).

Why all the fuss about the ISBA PwC Programmatic Supply Chain Study?

This study’s focus was the programmatic supply chain for open web display advertising – meaning it didn’t cover online advertising in walled gardens like Facebook, or Google-dominated paid search. It still covered dozens of advertising businesses whose purpose is to add value but who also charge fees. This generated hundreds of individual supply chains and back to Sam’s point, it’s complicated.

Even a world class auditor in the form of PwC struggled to unpick it. They successfully matched 31 million impressions served by study advertisers to study publishers. But another 236 million (88%) could not be mapped due to low data quality. And it took nine months to get the data from the tech vendors even after the participating advertisers, agencies and publishers were all ready and wanting to share their data. As Steve Chester, ISBA Media Director and study co-author said "because of the complex permissioning [i.e. contractual terms] between different suppliers’ themselves in the supply chain, not with agency or the publisher, it prevented ready and speedy access to the data".

What they found from the data they could use was, after agencies’ very reasonable 7% average fee, the multitude of businesses making up the complex tech intermediary supply chain took on average 42%, leaving just over half of spend (51%) reaching publishers.

Whilst some ad tech costs are inevitable, and there is no right answer for the percentage that publishers should receive, as Sam went on to say "intuitively that does feel low".

There was also the issue of an "unknown delta" between layers of technology - 15% of advertiser spend, around one-third of supply chain costs – could not be attributed.

Now there are a lot of reasons this may happen (counting discrepancies, forex variations, etc), and PwC themselves have said they don’t think anything nefarious is taking place. But it’s not a good look for the ad tech industry.

So what next?

ISBA have rightly called for cross industry investigation to explain what this unknown delta is and why it happened, as well as collaboration to drive industry standardisation.

This is something the IPA not only welcomes but also feels we, and our agency members, can be instrumental in. We will be working closely with ISBA, and with the IAB and AOP, to drive contractual and data standardisation into the programmatic supply chain.

Standardisation is a simple concept but a huge task in practice.

We have to be smart to find solutions – on a pragmatic level this means expanding the remit and energising the natural home for facilitating web standards, JICWEBS (the Joint Industry Committee for Web Standards) – whose founding bodies are… ISBA, the IPA, IAB and AOP.

It also means being smart in the concurrent development of innovative solutions. For the last 12 months JICWEBS has operated a Distributed Ledger Technology (DLT) pilot to evaluate the benefits this technology may provide to transparency and efficiency in… the programmatic supply chain. The preliminary results are very positive and will be released soon,possibly by the end of the month. DLT should help by providing a faster, secure and cost effective way for ad tech suppliers to implement standards; and accountability and automation.

If you have any questions about the ISBA PwC Study or indeed about cross industry collaboration and DLT please do not hesitate to contact me.