Kantar BrandZ partnered with University of Oxford’s Saïd Business School to identify new learnings on how brands can maximise commercial share price returns – with implications on what marketers should do differently.

Brands are funny things. On the one hand, this is a golden age for brands. We’ve never had as much empirical evidence demonstrating the competitive advantage brands deliver to business, and rules of thumb that help build their value, such as the 60:40 rule.

Yet much has changed over the past 15 years highlighting new challenges to models of ‘how brands grow’, and the way brands now deliver brand value to the bottom line in reality:

- the digitally connected economy creates new value through new channels, innovation and experiences

- sustainability has risen in importance

- inflation has exposed the importance of pricing power and margin as vital commercial levers alongside sales volume

So, it’s time to think differently about growth.

Factors driving breakthrough value creation

BrandZ is Kantar’s brand valuation engine of over 21,000 brands in 52 markets based on 4.2 million consumer interviews. It puts a value on the commercial contribution of brand equity, fuelled by three factors:

Meaningful: relevantly meeting functional and emotional needs in a category

Different: a combination of being seen as unique and leading the way

Salient: coming to mind easily when making a choice between brands

Investigating the data

We’ve put this dataset to the test in two new ways to understand what factors make the difference in driving the strongest growth performance in the modern economy by:

1. Partnering with the Oxford Saïd Business School to model which brand factors deliver ‘abnormal’ share price returns, and their relative importance.

2. Identifying BrandZ’s ‘breakthrough brands’ that have grown most rapidly in recent years to isolate what sets them apart from the rest.

Together, the analyses reveal insight into which strategic levers to focus on to maximise growth impact.

How brand difference can support company share price

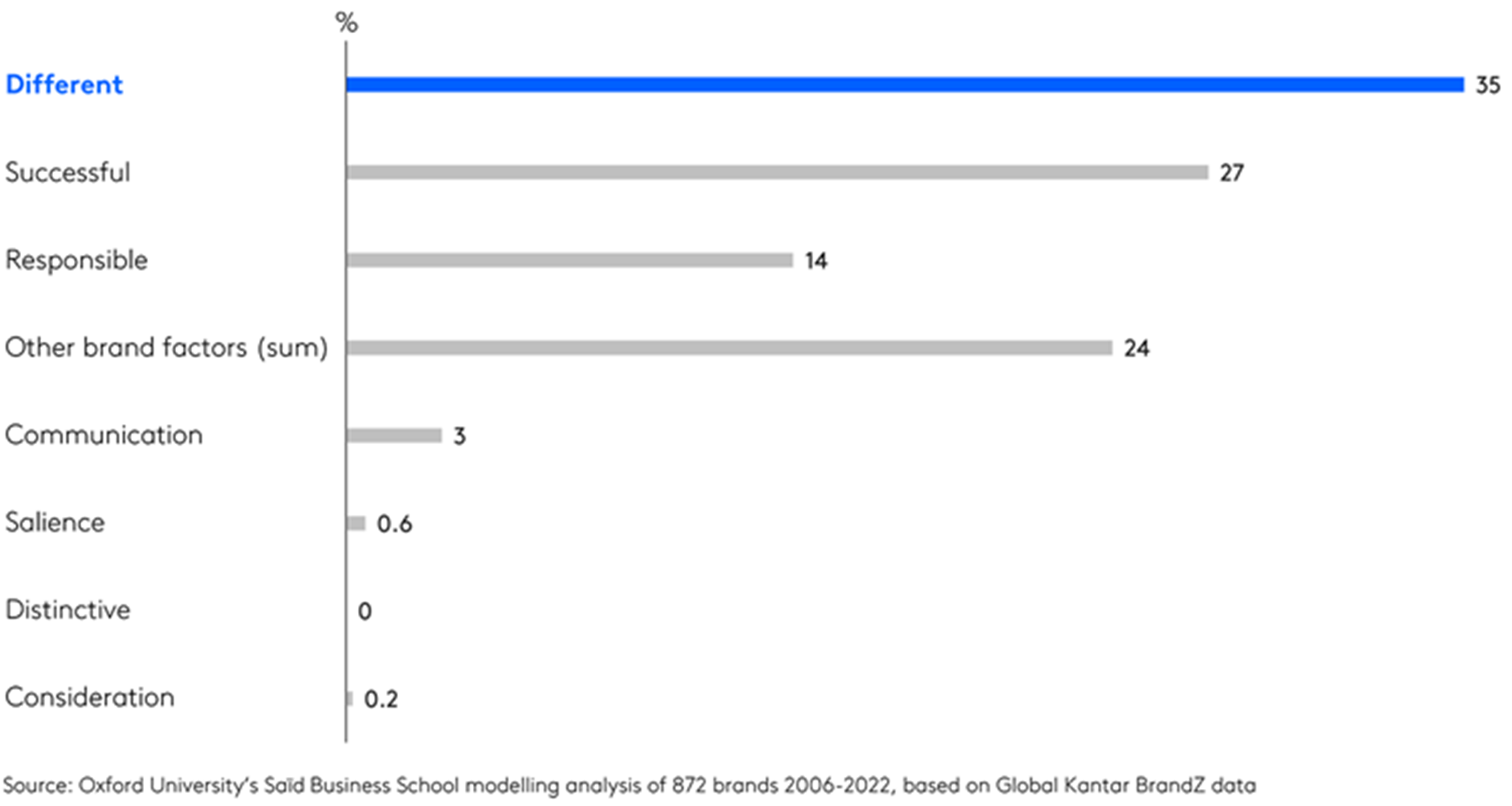

Saïd Business School analysed financial results from 872 brands between 2006-2022 across multiple categories, modelling outcomes incorporating BrandZ data. This showed:

1. Difference is the No. 1 factor on share outperformance (Corporate Responsibility was third)

2. Difference accounts for 35% of share growth, salience was just 0.6%

3. Difference is increasing in importance, salience decreasing

This evidence exposes as false the assertion that difference doesn’t exist between brands or matter much. Consumers do perceive it, and it plays a primary role in brand share price.

Brand drivers of share price

BrandZ Breakthrough Brands analysis

Kantar analysis of BrandZ ’breakthrough brands’ (fastest-risers +5% YoY and new entrants to Kantar BrandZ Most Valuable Global Brands.) shows any brand can be a ‘breakthrough brand’. They come from every category and every kind of maturity. Examples include KFC, Cadbury, Johnnie Walker, Chipotle, Lululemon, Tesla, Aldi, Uniqlo, TikTok and Airbnb as well as Kantar BrandZ’s No. 1 most valuable global brand, Apple.

So, what makes these breakthrough brands different? In a word: Difference. While meaningfulness, salience and difference each play a role in the performance of these brands, they are seen – and experienced – as being relatively more different from competitors. Difference is their real rocket fuel for growth.

How breakthrough brands are hardwired for difference (Index vs Global average)

We can see the importance difference plays by going a step further in factoring out the role brand size plays, by analysing the brands that grew market share over a 3-4 year period and comparing their starting equity position relative to brand size with the net chance of gaining share. This reveals which brands grew beyond what would have been expected given their size: what we’ve called a relative ‘excess’ level.

This analysis shows brands with ‘excess’ Meaning or Salience had only small chances of growth. In contrast, starting with ‘excess’ difference turbocharges their growth potential. And the stronger their relative excess difference, the stronger their growth rate.

How ‘Excess’ difference (factoring out brand size) drives the strongest growth

So, if you want your brand to grow, and grow faster than competitors, Difference is what makes the difference.

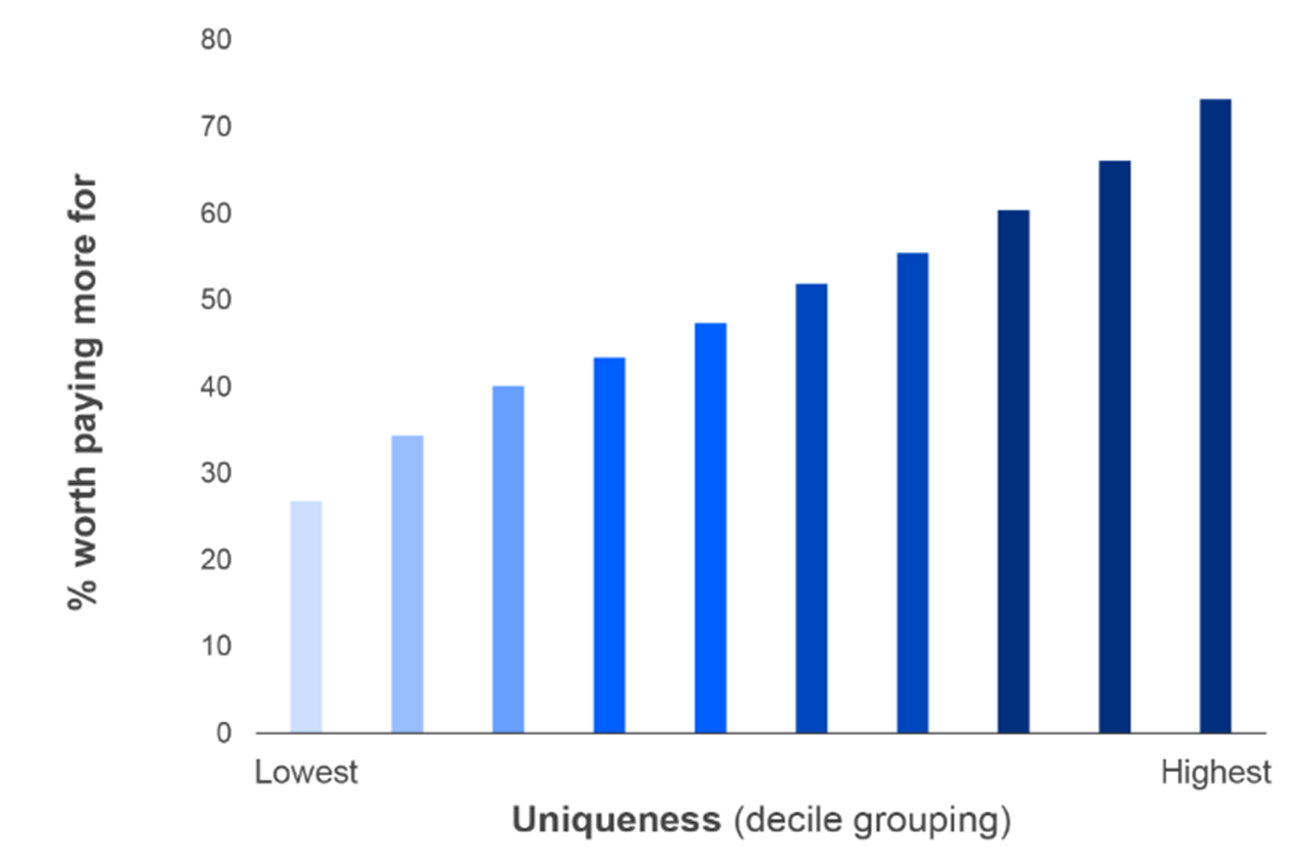

Difference drives pricing power

Kantar’s data shows the stronger perceptions of a brand being unique, the stronger perceptions that it is ‘worth paying more for’ are.

Difference is worth paying more for

In fact, different is the leading driver of Pricing Power in many categories - on average Meaningful and Different together account for 94% of Pricing Power, and salient just 6%.

This creates a huge commercial growth advantage as Pricing Power flows directly to the bottom line: McKinsey reports that a 1% increase in price improves operating profits by 8% - three times the boost to profits generated by a 1% increase in volume sales.

Meaningful Difference is also a stronger factor than saliency driving the pipeline for future sales too, building a protective cashflow around a brand where profits can be more deeply and consistently reinvested back into the business.

This dynamic can be summarised in a brand value chain: Demand Power (sales volume) is driven by meaningful salience, Pricing Power (sales value/margin) is driven by Meaningful Difference.

The implication here is that mental and physical availability, while important, is not enough. To fully unlock a brand’s commercial growth requires doubling down on creating a perceived difference, which strengthens pricing power and margin potential - and that’s never been more important for success than now in inflationary times.

Design for Difference

Kantar factor analysis on the levers of difference highlights how it’s created by the sum of tangible AND intangible factors which connect to forge brand memories.

Distinctive brand assets (colours, fonts, slogans, characters, etc.) certainly play a role, accounting for 30% of difference. But the vast majority – over 70% of difference - is made from other intangible factors including positioning, product experience, service design, advertising associations, range relevance and responsibility.

Each of these factors stimulate sensory connections in the mind, enhancing brand predisposition, or as Jeremy Bullmore once put it ‘brands are built as birds build nests, from the scraps and straws they chance upon’. This primes people to buy, pay a premium, enjoy the experience more and be less likely to leave for competitors.

Learn from brands with clear difference

The implication here is that consistent use of Distinctive Brand Assets, while valuable, is not enough either – breakthrough brands Design for Difference by continuously challenging category convention to do things differently and better, whether as a leader, a challenger or a new entrant.

Contrary to being ‘meaninglessly distinctive’ as Byron Sharp puts it, they are deeply purposeful in designing meaningful difference into every marketing activity.

Apple, BrandZ’s biggest brand in the world with also twice the level of difference to the average, is a great example of how to do this using every marketing ‘P’. It starts with a clear compelling position, amplifies it with powerful emotive communications and reinforce it through emotively differentiated utility innovation, packaging and product/service experiences (such as Genius Bars). And Apple does it consistently.

IPA Effectiveness Awards Grand Prix 2022 winner Cadbury, which works very closely with Kantar, is a brand with strong all-round equity including ‘excess’ difference of +5. The foundation for its growth has been defining a uniquely compelling brand territory – Generosity – which has been brought to life consistently in Cadbury’s ‘There’s a glass and a half inside everyone’ creative campaign over 5+ years with emotive creative. For an example, see Kantar’s Xmas ad of the year Cadbury’s ‘Secret Santa’.

In our creative excellence panel at Cannes with Cadbury, the brand revealed a simple key to success:

Jonny McCarthy, Global Head of Brand, Cadbury, said: “Do what others aren’t doing & keep doing it consistently.”

Thinking differently about brand growth

Deploying distinctive brand assets and growing salience/mental and physical availability are vital in driving volume sales, but they’re only half the story when it comes to growth.

Designing for, and delivering meaningful difference, relative to competitors through experience, innovation and comms are critical to priming future purchasing & driving price power that flows to the bottom line – and that’s the commercial rocket fuel that unlocks a brand’s full value on the balance sheet.

What this means in practice

- Ensure your brand strategy is compellingly emotionally differentiated – without this, you’re building a castle on sand.

- Use a creative platform that enables your brand story to come to life emotionally (even if based on product benefits) by ‘doing what others don’t’. Shape market conventions, don’t follow them.

- Consistency is the strongest creative weapon you have (memories build slowly): so don’t think in throwaway executions. Think in 5-10+ year campaigns which slowly build like a soap opera with a uniquely familiar story and cast which slowly evolves.

- Design Difference into your media & investment plan with high attention high impact channels that reinforce your emotional differentiation. (New Kantar evidence we’re sharing at an IPA EffWorks 2023 satellite event shows emotive digital channels like Tik Tok can be some of the strongest at building brand difference and equity.)

- Put in place an agile measurement framework that links to brand meaningful difference not just creative salience impact:

Breakthrough brands are showing up consistently everywhere. So, take a leadership role by connecting silos and ensuring your innovation, experience and sustainability strategies all play their part reinforcing your brand’s meaningful difference emotionally & rationally.

For more info see Kantar IGNITE, breakthrough thinking for brand leaders.

Dom Boyd is Managing Director, UK Insights and Marketing Effectiveness Practice, UK, Kantar

Book your ticket for 2023 EffWorks Global

The opinions expressed here are those of the authors and were submitted in accordance with the IPA terms and conditions regarding the uploading and contribution of content to the IPA newsletters, IPA website, or other IPA media, and should not be interpreted as representing the opinion of the IPA.