Matt Hill, Director of Research & Planning at Thinkbox, the marketing body for UK commercial TV, argues that while investing in ESOV is not popular, it can give brands a competitive edge.

It’s 2023 and it’s all a bit grim. We're so used to grim now that we might mistake it for normality. We’re in the middle of a cost of living crisis thanks to a war in Europe and its impact on energy prices, and a hangover from Brexit. The after-effects of the pandemic are still being felt. The after-effects of Liz Truss too.

Marketers once again find themselves in unfamiliar territory. Most haven’t operated in an inflationary environment before and, even if the likelihood of a recession has receded, there is a whiff of caution in the air. AA/WARC advertising investment forecasts have been downgraded to suggest a small rise of 0.5% in 2023 in the UK, with the only real growth coming from spend in search advertising, which is mostly used as digital point of sale and is closer in nature to shelf wobblers than to most advertising.

So, with UK annual inflation as measured by the Consumer Prices Index still above 10% in March 2023, there are two things that marketers should really care about this year:

- Price sensitivity/elasticity

- Excess Share of Voice (ESOV)

The importance of price sensitivity is obvious, because inflation means business input costs go up and as a result, most businesses will need to put up their prices to protect their margins. If your product/brand is highly sensitive to such price fluctuations, then sales volumes will suffer.

The need to focus on the brand’s Share of Voice (SOV) may be less evident, but still matters. First, a brand’s SOV can affect its price sensitivity. Econometric agency Gain Theory suggests a rule-of-thumb relationship between SOV and reduced price sensitivity where a 10% increase in a brand’s SOV can result in a 5-20% reduction in its price sensitivity. This happens because stronger brands, supported by advertising, are better able to protect market share and profit margins when their prices have to rise since people are still more likely to choose these brands even at a higher price.

Great time to buy more SOV

Second, now is a great time to buy more SOV – especially in media where price is based on supply and demand (like TV, although other media are available). Increased value is on offer to TV advertisers due to the weaker demand among advertisers because of the economic uncertainty.

Data from Q1 2023 shows that the number of brands advertising on UK linear TV was down and that most advertisers were buying fewer ad ratings than in the same period last year. With TV viewing stable, the end result is a deflationary TV market offering opportunities for advertisers to get more for their money.

But isn’t investing in growing SOV a rather blunt marketing tactic in today’s world? Well, it’s certainly one that doesn’t always sit comfortably with boards – no serious FD enjoys seeing the company’s marketing department actively looking to spend more money than its competitors. It’s also (thanks to the growth of digital walled gardens like Facebook or TikTok) a lot harder to measure a brand’s total SOV than it was 20 years ago.

But committing to achieving ESOV – namely, investing in having a greater share of voice than the brand’s market share in order to grow that market share – is a proven strategy. Just ask Les Binet, Peter Field, Byron Sharp, Mark Ritson or Karen Nelson-Field (although Karen will argue that attention-adjusted SOV is even better!).

A clear example that shows achieving ESOV still works as a marketing tactic can be found in a July 2022 article from The Grocer about the black tea market. It reported that ‘Yorkshire Tea was the only traditional tea brand in growth last year, with value up 3.4% to £119.1m. Bettys and Taylors (the brand’s owner) said Yorkshire Tea’s market-leading position also strengthened, with share rising to 33.7%.’

Storm in a black tea cup

Last year Yorkshire Tea was rocking a 45% SOV in the traditional tea advertising market on TV. On occasions over the previous five or so years, it has been the only black tea brand advertising on TV. Back in 2015 Yorkshire Tea had a 20% market share, so several years later to be sitting on almost 34% market share is a phenomenal achievement. The fact the brand has utterly brilliant creative from Lucky Generals certainly helps – but this is also a case of the benefits of ESOV in action.

More recent data from a different category also shows ESOV strategies in evidence. Below, I’ve used the supermarket category because a) there aren’t that many operators in the UK, so the data is easy to visualise, and b) it’s pretty straightforward to get data on supermarkets’ revenues and estimate market shares.

Sustaining ESOV in the supermarket category

One caveat about the rule of thumb that links ESOV to market share growth (i.e., 10% ESOV delivers circa 0.5% market share growth) is that it doesn’t quite apply to supermarkets in the same way as to other businesses, since store volumes, sizes, drive time, and population densities are much more critical factors in market share gains/losses in this category. However, as the UK supermarket category is worth circa £200 billion a year, a market share gain of 0.1% is worth £200m, so even if there is a weaker relationship between ESOV and growth in this category, sustaining ESOV can still be an important goal for supermarkets.

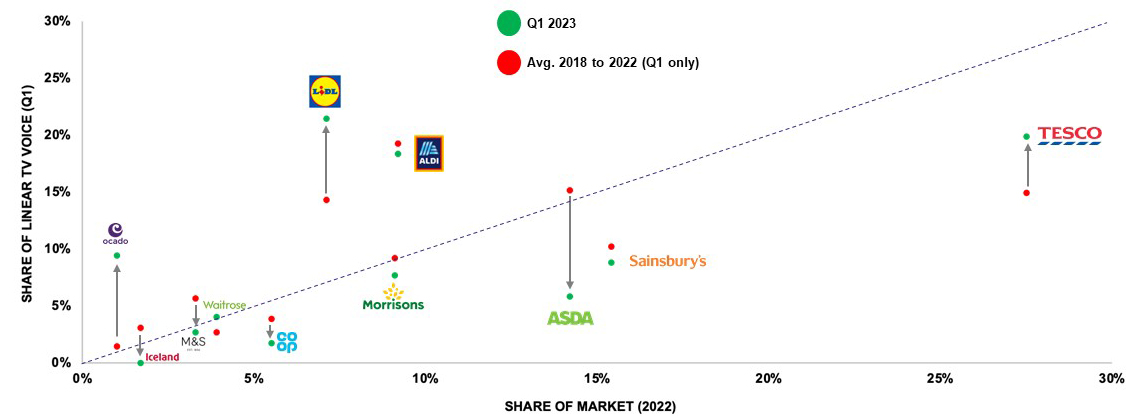

The chart below shows the major supermarkets’ linear TV SOV for Q1 this year (the green dots) compared with the first quarter of the previous five years (red dots) and plots this against their 2022 market shares.

UK supermarket TV share of voice Vs share of market

First, you can see that there is a general relationship between TV SOV and share of market (SOM). The bigger the supermarket, the higher the TV SOV. But we can also see that there is quite a bit of change this year. Lidl and Ocado are clearly seeing that this year is an opportunity and are investing in ESOV, also Aldi are maintaining their high SOV. Tesco looks to have responded with a defensive play. Sainsbury’s, Morrisons and, in particular, Asda look to be playing it cool.

Admittedly, this is only a part of the picture. It only covers linear TV ad spend and the pattern could be different if we looked across all media spend. But, with TV accounting for over 80% of all video-based advertising (and video recognised by most as the most effective format), this is a good place to start.

Staying on top of what’s happening in your market can be a challenge, but there are tools out there that can help. ITV’s SOV calculator is a very handy system that covers TV share of voice across the whole of linear TV (not just ITV) as well as TV sponsorship (see AdLabs Insight: Share of Voice by ITV | ITV Media).

Share of voice battles are in play right now and, due to the current financial climate, 2023 looks to be a critical year where there could well be significant advantages to be gained for those prepared to be bold.

Book your ticket for EffWorks Global 2023

The opinions expressed here are those of the authors and were submitted in accordance with the IPA terms and conditions regarding the uploading and contribution of content to the IPA newsletters, IPA website, or other IPA media, and should not be interpreted as representing the opinion of the IPA.