When markets rebound, faster growth is on the table for brands with extra share of voice.

Despite the inherent uncertainty of making predictions in a pandemic, economic forecasts have consistently improved in recent months.

At the end of May, the OECD upgraded its growth projection for the global economy in 2021 from 4.2% to 5.8%. Later, both the US Federal Reserve and the European Commission reported improved growth outlooks for their respective economic areas.

And anticipation of a strong UK recovery underpinned the first upwards revision of UK marketing expenditure since the end of 2019 detailed in the latest IPA Bellwether Report.

But the hard truth is that this growth won’t be shared equally amongst all businesses and their brands.

So there has probably never been a better time to focus on what we know about how to accelerate the growth of brands, and how we add to that knowledge.

As previous IPA reports, such as Effectiveness in Context, have consistently argued, committing to extra share of voice (ESOV) – namely, investing in a greater share of media spend in the category than the brand’s market share – is the foremost way to increase a brand’s market share.

This is a particular acute insight in the early stages of recovery since investing in ESOV now can enable brands to extract greater competitive advantage over rivals who cut marketing investment and weakened their brands during the recession.

‘To ESOV and Beyond’, a new report published by the Advertising Council of Australia (ACA), sheds new light on the power of ESOV. The report expands on current knowledge showing ESOV’s linkage to mental availability gains and its impact on a raft of long-term success metrics – not just market share growth.

The study, written by myself, Peter Field and Professor Karen Nelson-Field, is built on analysis of the ACA’s Effectiveness Database of Effie cases.

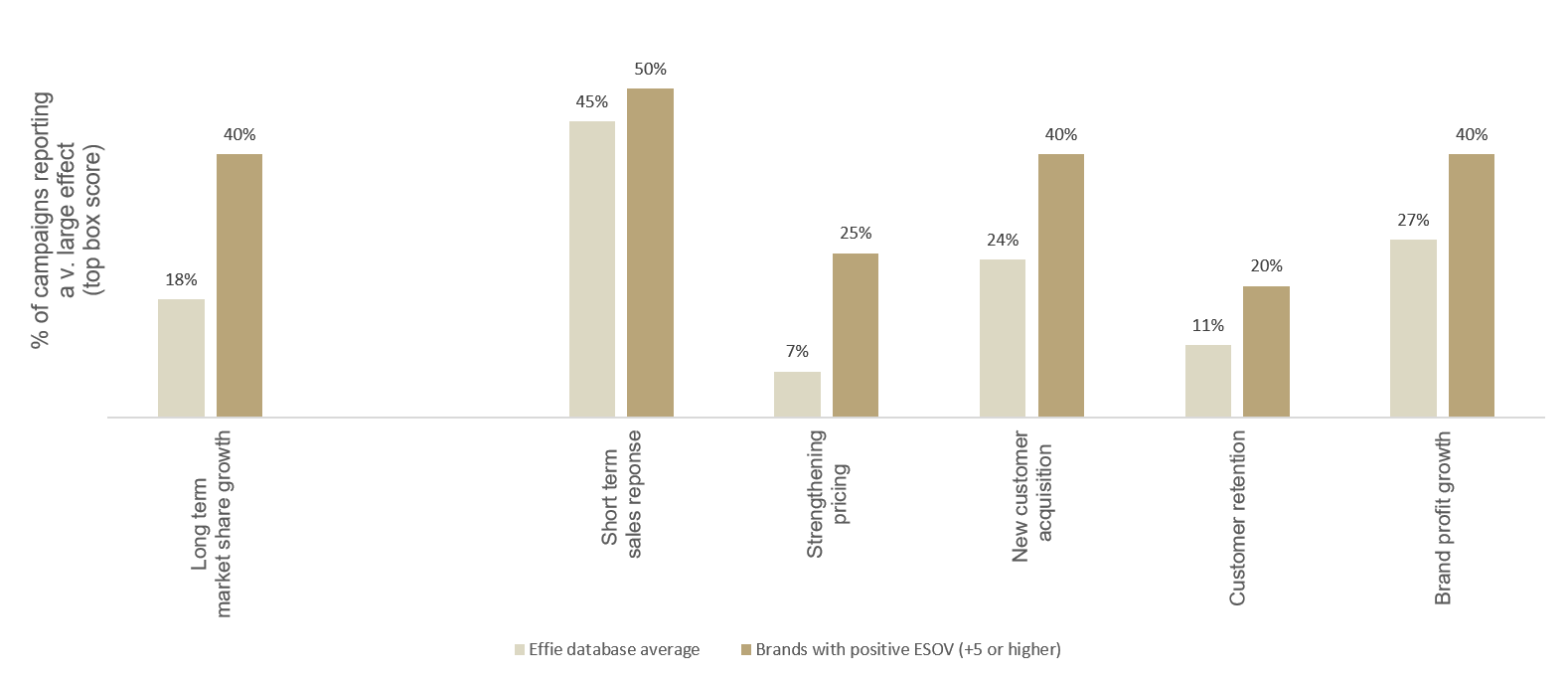

It found that brands with high ESOV reported a higher average number of very large brand and business effects than the database average and that the effects are across a much broader set of key metrics than originally thought.

As expected, the high ESOV campaigns were more likely to report long-term market share; however, stronger effects were also observed on profit growth, customer acquisition and retention and strengthened pricing.

For bigger brands, the business benefits from investing in a high ESOV were even greater than for smaller brands.

Critically, the report looked at the impact of ESOV on mental availability gains and business effects at different budget levels showing that it is ESOV, not absolute media investment, that is more important to campaign effectiveness.

This further broadens the applicability of ESOV from being an important budget planning input to also being a key variable when assessing campaign performance. Given ESOV is achievable for a brand of any size, marketers should take heart that mental availability gains and the associated business effects are possible to achieve regardless of the brands position in the category. Smaller brands don’t need to outspend their bigger competitors, but they do need to spend at a level that is relatively higher than their size.

But while arguing that Share of Voice remains an important concept for both budget setting and the judgment of business results, the report sets out why it needs to adapt to several current challenges.

First, measuring a brand’s Share of Voice in its category is getting more difficult because of the amount of advertising spend in the category that goes into digital ‘walled gardens’ and formats where it is more difficult to track and compare brand spend.

A second and related challenge is that of comparing the value of impressions bought in digital and analogue media formats, given the debate over attention levels and fraud in digital media formats.

Third, there is the question of how to account for how the strength of creative, which can also drive effectiveness, works in relation with ESOV investment.

Finally, there has been increasing industry interest in the potential uses of the Share of Search concept – namely, a brand’s share of organic search queries in its category – as a source of insights into the brand’s position in the market and future business performance. Could it even be a replacement for SOV in some instances?

The report argues that while Share of Search can be a useful data source in some contexts, it cannot be a straightforward replacement for SOV. For a brand to be searched for, it needs to have already achieved a degree of mental availability, which as argued above, is effectively achieved by investing in ESOV as well as creative strength and media selection.

As the report states, “share of search is an outcome of other marketing activity that occurred before it. Like a thermometer, it [share of search] measures the temperature but cannot be used to turn up the heat, and can be affected by many other factors. SOV (advertising intensity) on the other hand, is the thermostat you use it to turn the temperature up or down.”

So given that ESOV is a proven driver of brand growth, albeit one in need of some updating for contemporary media markets, what can clients and agencies do today to ensure they are taking advantage of the available evidence in this field?

It goes out without saying that we believe they should download a copy of To ESOV and Beyond, which also includes new thinking on the impact of media selection and on attention, not discussed here for reasons of space.

Even for those teams that don’t employ SOV as a planning input, understanding the concept can improve the team’s thinking and since SOV is a competitive measure, it can be a useful way to frame conversations between marketing and other parts of the business. For those teams that already use SOV as part of planning and budget setting, the new evidence on how it can impact a wider range of brand and business metrics can help sharpen their perspective.

And as the recovery strengthens in markets worldwide, growth is for grabs for those marketers that employ the best thinking about brand growth, and are prepared to back it with the right investment, media strategy, and creativity.

Robert Brittain, ([email protected]), Director of Robert Brittain Consulting, is an independent marketing consultant and co-author with Peter Field, of the first edition of Australian Advertising Effectiveness Rules, and the 2020 report, Winning or Losing in a Recession.